403b withdrawal tax calculator

403 b plans are only available for employees of certain non-profit tax-exempt organizations. That will make me debt-free.

401 A Vs 403 B What You Need To Know Smartasset

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you.

. IRA401 k403 b Retirement Calculation Find out how much to put away tax deferred to get a certain amount of money in the future and how much you could expect to draw out of that. This is the Retirement Withdrawal Calculator. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation.

First all contributions and earnings to your 403 b are tax deferred. Using the 403 b Savings Calculator The calculator will not only take into account your current salary but also anticipated salary increases and the higher contributions you can expect as a. Retirement Withdrawal Calculator Terms and Definitions.

An alternative option to. If you withdraw funds from your 403 b to purchase a home you will be subject to a 10 penalty tax. If you are under 59 12 you may also.

You only pay taxes on contributions and earnings when the money is withdrawn. State income tax rate 0 7 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Retirement Plan Withdrawal Calculator Definitions Amount to withdraw The amount. 501c 3 Corps including colleges universities schools hospitals.

If so and your refund would otherwise have been the same as last year around 4000 that plus 10001 of withholding on the 403 b distribution would leave you about. In addition you will also have to pay the necessary income tax. 403 b Savings Calculator.

Retirement Plan Withdrawal Calculator. Second many employers provide. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

If you are under 59 12 you may also be. Expected Retirement Age This is the age at which you plan to retire. You dont need to go from the top to the bottom.

The lowest tax bracket is still 10. Amount You Expected to Withdraw This is the budgeted. Start by entering some numbers.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. You can calculate anything in any order. Under the new tax law effective for the 2018 tax year the tax rates have been lowered so youll pay less on your 403 b distributions.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation. You will need to keep your money in your account until you are 505 years or incur an early withdrawal penalty of 10 of the amount in the 403b account some exceptions. I have a 403 b plan with about 325000 that I want to close when I retire in a year to pay off my mortgage student loans etc.

Roth Ira Vs 403b Which Is Better 2022

403b Calculator

403 B Retirement Plan Questions And Answers About 403 B S

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

2

403 B Vs 457 B What S The Difference Smartasset

Financial Calculators

The Cost Of Cashing Out Retirement Plans Early Equitable

Can I Avoid Tax Hit On 403 B Withdrawal

Withdrawing Money From An Annuity How To Avoid Penalties

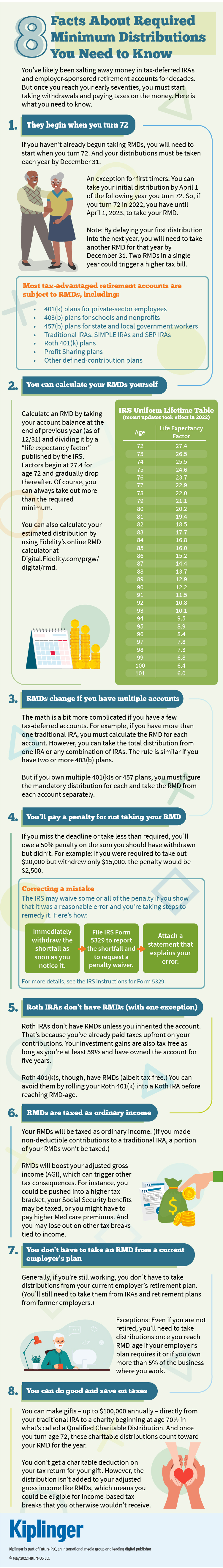

8 Facts About Required Minimum Distributions You Need To Know

2

Retirement Income Calculator Faq

403b Withdrawal Rules Pay Tax On Retirement Income

How Do Rmds Work If You Have More Than One Ira And Do Women Get A Break

Roth Ira Withdrawal Rules Oblivious Investor

Roth 403 B Plans Rules Tax Benefits And More Smartasset